XM Broker Review (2023) ++ Scam or not? | Real test

XM BROKER

|

| XM BROKER |

REVIEW: | REGULATIONS: | SPREAD: | MIN. DEPOSIT: | ASSET: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | FCA. BaFin, CNMV, MNB, CONSOB, ACPR, FIN-FSA, KNF, AFN, FSC | Starting 0.0 Pips | 5$ | 1000+ |

You should avoid XM online broker or is it a recommended company? – On this page we share our own experience in the form of a test report on this forex and CFD broker . Learn about the requirements and offers for traders in the following text. A step-by-step tutorial on how to trade successfully. Is it worth investing his money? – Tell now transparently

(Risk warning: 75.59% of retail CFD accounts lose)

What is XM.com? – forex brokers offer

XM Group (XM) is a control group. Online broker . Trading Point of Financial Instruments Ltd was established in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10); Trading Point of Financial Instruments Pty Ltd was established in 2015 and is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10). Regulated by the Australian Securities and Investments Commission (ASIC 443670) and XM Global Limited was established in 2017 and is headquartered in Belize. and under the supervision of International Financial Services Commission (IFSC/60/354/TS/19). The company was founded in 2009 and has grown to more than 1,500,000 clients in more than 196 countries. Even the broker is one of the largest in his industry.

Its goal is to provide clients with a fair and reliable offer for investing in international financial markets. Customer support is of the utmost importance to this company and is available in over 30 languages. We will definitely check this in the following experience reports. In addition, the broker plays a very active role in publishing and support. especially for customers This broker can be found at seminars or financial events around the world.

XM offers currency trading (Forex) and CFDs on commodities, precious metals, energies, shares and indices. Currently, more than 1,000 different markets are available to traders. In addition, the broker works as an intermediary for contracts for difference. The offer is huge at first glance. and company information proved to be reliable.

Facts about the FX broker XM.com:

⭐ Rating: | 5 / 5 |

🏛 Established: | 2009 |

💻 Trading Platform: | MetaTrader4, MetaTrader5 |

💰 Minimum deposit: | $5 |

💱 Account Currency: | dollars |

💸 Withdrawal limits: | no limit |

📉 Minimum Trade Amount: | $1000 trading volume / 0.01 lot |

⌨️ Demo Account: | Yes, up to $10,000 |

🕌 Islamic Account: | yes |

🎁 Bonus: | $30 bonus for each new real account |

📊 Assets: | Stocks Commodities Stock Indices Precious Metals Energies |

💳 Payment methods: | bank transfer Debit/Credit Cards (Visa and Mastercard) Skrill |

🧮 Fees: | Starting at 0.0 pip spread, variable overnight fees. |

📞 Support: | 25/7 support via phone, mail and chat. |

🌎 Languages: | 25 languages |

(Risk warning: 75.59% of retail CFD accounts lose)

What are the pros and cons of XM?

We know that there are many brokers to choose from. Choosing the perfect broker can be challenging. So here are some of the most important pros and cons of the broker to help you decide if XM is a good fit. What we like about XM is their focus on customer success. according to their website The broker has more than 10,000,000 clients from 190 countries.

Advantages of XM | Disadvantages of XM |

✔ Dedicated personal account manager | ✘ Only USD is available as standard account currency. |

✔ Low minimum deposit | ✘ Ratings on Trustpilot are not great. |

✔ Website and customer support available in 25 languages. | ✘ Some users complain about the complicated withdrawal process. Even if that's not our personal experience. |

✔ The website is highly optimized for mobile users. | |

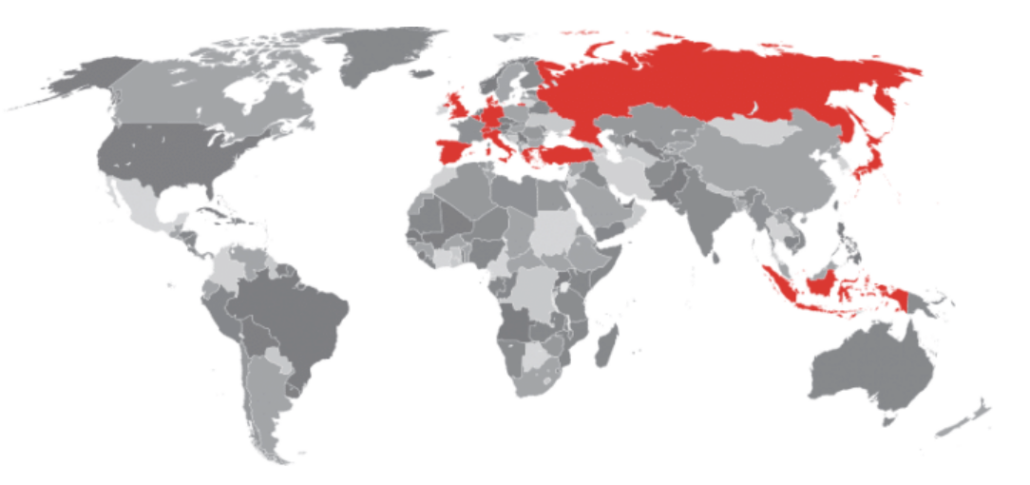

✔ International traders from most countries accepted | |

✔ Professional and fast customer support | |

✔ Cheap fees and commissions |

XM regulation and safety of client funds

Official regulations or licenses exude reliability and safety. Every trader should find out about opening an account with a broker. The regulation aims to drive frivolous fraudsters out of the market. The license is required to have certain criteria and regulations that guarantee a clean and safe trade.

Another good impression for us is that XM has several licenses. in more than four countries The broker is regulated by an official financial regulator. The company is also registered in several European countries with proper supervision. and is free to provide EEA services.

In addition, client funds are managed in various investment grade banks. XM only does business with regulated payment providers. The broker is also a member of the Investor Compensation Fund. XM does not trade with clients. which is forbidden by the regulations and for greater safety Negative balance protection is available.

Which entity is XM regulated by?

XM is a highly trusted broker with numerous official certifications. This makes XM one of the safest and most trusted companies in the industry. Below you will find a list of XM entities regulated by:

- Cyprus Securities and Exchange Commission ( Circi )

- Financial Conduct Authority ( FCA )

- Federal Financial Conduct Authority ( BaFin )

- Securities and Exchange Commission ( CNMV )

- Board of Directors and the Italian Stock Exchange ( Consob )

- French Regulatory and Resolution Agency ( ANCP )

- Finnish Financial Supervisory Authority ( FIN-FSA )

- Polish Financial Supervisory Authority ( KNF )

- The Dutch Financial Market Supervisory Authority ( AFM )

- Financial Regulatory Authority ( F.I. )

- Financial Services Commission (CRES)

Why XM is a very safe online broker:

- Member of the Investor's Compensation Fund (for Trading Point of Financial Instruments Ltd. only)

- XM does not trade with clients.

- Client funds are held in segregated client bank accounts.

- Negative balance protection

ESMA regulations

As of 2018, leverage for traded derivatives (Forex and CFDs) is heavily limited to 1:30 by the European Financial Services Authority (ESMA), a broker licensed in Europe. It is only allowed to offer this mini lever to customers. This is a major problem for some traders as it is no longer possible to execute certain strategies (such as hedging).

However, the 1:30 leverage applies to clients registered under the bloc's EU-regulated entity. Leverage depends on the financial instrument traded.

(Risk warning: 75.59% of retail CFD accounts lose)

Review of XM Trading Conditions for Traders

XM is very broad, with over 1000 tradable instruments, there should be no shortage of options for traders. As mentioned above, Stocks, Commodities, Currencies (Forex), Precious Metals and Energies. Stock trading in particular is a huge advantage with XM having assets from over 14 countries to choose from.

Available markets:

- currency

- Stock CFDs

- Commodity CFDs

- Index CFDs

- Metal CFDs

- Energy CFDs

In terms of trading platforms, XM relies on the world famous MetaTrader 4 and 5. This is one of the best software for private traders. We will provide a more detailed description in the trading platform section.

Trading conditions for leveraged financial products are excellent and competitive from my experience and testing. XM relies on several different account types. which provides traders with excellent conditions depending on the strength of the capital Spreads can start from 0.0 pips on most traded markets. In addition, the execution is very reliable. and no requote 100%

as a trader You can start trading with as little as $5 minimum deposit or use a free demo account. There are also different account types for all types of funds. (Additional later) In conclusion, various conditions Make a positive impression on us and XM can be one of the cheapest and most reliable brokers.

Conditions for traders:

- Spreads starting at 0.0 Pips

- different types of accounts

- The maximum leverage is 1:30 for clients registered under an EU regulated entity.

- The maximum leverage is 1:500 for clients registered under Belize or ASIC regulated entities.

- Minimum deposit 5$

- Free and unlimited demo account

- More than 1000 different markets

REGULATIONS: | SUPPORT: | ASSET: | SPECIAL: |

|---|---|---|---|

CySEC, ASIC, IFSC | 24/5 in different languages, webinars and training tutorials | 1,000+ (Forex Trading, Stock CFDs, Commodities CFDs, Stock Indices CFDs, Metals CFDs and Energy CFDs) | different types of accounts |

(Risk warning: 75.59% of retail CFD accounts lose)

XM Trading Platform Review and Test

As mentioned earlier in this review. Versions 4 and 5 of the well-known Metatrader trading platform are offered in our opinion. There is no better trading platform for private traders worldwide. Because there are many universal options. The trading platform is characterized by its flexibility and user-friendliness.

With MetaTrader you can adapt your trading to any trading style. The platform is customizable and programmable. Be it long or short, Metatrader always provides the right settings. This program allows the use of robots or automated programs.

The following trading platforms are available:

- MetaTrader 4 (web, mobile app, desktop)

- MetaTrader 5 (web, mobile app, desktop)

Advantages of XM MetaTrader:

- Log in once and access the exchange, app and desktop version.

- may use an automated program

- no requote

- Can rent a VPS server

- There is a complete video tutorial from XM.

(Risk warning: 75.59% of retail CFD accounts lose)

Charting and Analysis for Forex Trading

Of course, charts and analysis are very important for successful traders. It is not uncommon for merchants to even need access to external software. This is not necessary for XM as MetaTrader offers all the major charting and analysis options. Choose between more than four chart types in the software.

The time frame (time unit) of the chart can be set for analysis. The software also has the right tools. Free indicators can be added at any time. There are also several drawing tools. If that's not enough You can program the indicator yourself or insert it externally.

- Personalized customizable tools

- free indicators

- Wide range of technical drawing tools

Trade via mobile phone on any device.

Another advantage of the software is that it can be used on all devices. Use MetaTrader on Apple (iOS) and Android devices too. Mobile trading is now a standard requirement for trading software. Because it is essential to be able to respond to news from the inside. Locations can be turned on, managed or turned off with your smartphone. In addition, you only need access to each device. with your account information You can login anywhere.

(Risk warning: 75.59% of retail CFD accounts lose)

Trading Tutorial: Learn How To Trade With XM Step By Step

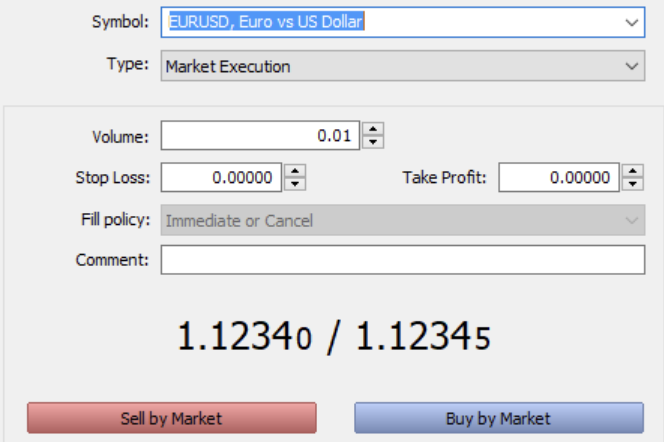

in the following section We would like to give you some tips on trading with XM Forex broker in the image below. You will see MetaTrader's command mask with various configuration options. Plenty for trading operations The following points will tell you how the typical trading process works.

- First, analyze 1 out of 1000 markets/assets at XM and decide to invest or open a trading position. for this purpose Fundamental analysis or technical analysis can be used. MetaTrader has enough tools and settings.

- As you can see in Order Mask, you can always bet on rising or falling prices. This is easily done with forex trading and occurs during CFD trading via short selling.

- Now you have to choose position size (volume) and stop loss or take profit. The total size depends on your planned risk exposure. Choose specific price tags when opening and closing trades. The position size is set in lots (1 lot = 100,000 units of the base currency). Beginners should definitely use the XM Forex Calculator which is available on the website.

- A stop loss will stop you in a loss at a certain price (risk) and a take profit will automatically close your position at a certain price in profit. Learn how to share the profit/risk ratio.

- Pending orders are another way to open a position. Place an order at a specific price in the market. If the market touches this price Your position will be opened. (Whether selling or buying)

Open a free account with XM

Next we want to look at account opening in this review. On the website it is clear that you can directly open a demo or real account. in minutes Opening the inventory will work as a support. Use valid email and other personal information. Email addresses must be verified after opening an account.

Free and unlimited demo account

The demo account is a virtual balance account. You can use it to try out all features of the XM broker and trade risk-free. It simulates real money trading with "play money". It's also a great way for beginners and advanced traders to develop their own strategies or test new markets.

XM offers a free demo account with over $10,000 in virtual credits. If desired, currencies other than USD may be used. This account can be used indefinitely. And it's the perfect way to practice with a broker.

How to open your real account

Once you have chosen XM, you can open a real money account. This requires more information. The broker also asks a few questions about your trading knowledge before opening an account. You must verify your phone number for additional account security. before capitalization The account should and should be verified. This is very easy by uploading your passport and proof of residency.

XM will guide you through the account opening process. Detailed and accurate step-by-step instructions are provided to ensure everything goes smoothly. If you have questions You can contact support. In short, opening an account is very easy and works quickly.

(Risk warning: 75.59% of retail CFD accounts lose)

Choose the best account type for you.

XM offers the advantages of 3 different account types. It is possible to decide between "Micro", "Standard" and "XM Zero" accounts. The account type is adapted to the strength of the client's funds. You can trade with very small positions. (A few cents at risk) There is a separate cent contract size.

On “Standard” and “XM Zero” accounts there is an average lot size. The difference between these two accounts lies in the fees and possible account currencies. For example, you can choose seven currencies for the standard account and only 2 for the “XM Zero Account”. XM Zero Account” and it starts at 0.0 pips but you have to pay a commission of $3.5 per $100,000 traded. “XM Zero Account” is much cheaper than a standard account.

| XM MICRO ACCOUNT VERY LOW | XM ULTRA LOW STANDARD ACCOUNT | XM ZERO ACCOUNT | |

|---|---|---|---|

| MIN. DEPOSIT: | 5$ | 5$ | 5$ |

| CURRENCY: | USD, EUR, GBP, CHF, AUD , HUF, PLN | USD, EUR, GBP, CHF, AUD , HUF, PLN | USD, EUR |

| SPREAD: | 1.0 Pips | 1.0 Pips | 0.0 Pips |

| BOARD: | no | no | Commission 3,5$ per 1 lot traded |

| ISLAMIC ACCOUNT | yes | yes | yes |

(XM also offers the XM ULTRA LOW account which allows you to trade either micro or standard lots. spreads are lower from 0.6 pips and with a minimum initial deposit of $5, the XM ULTRA LOW account is not available for all entities of the group).

Should you choose fixed or variable spreads?

Some brokers offer fixed spreads. This means that the spread (The difference between the buy and sell price) is always the same. He is also independent of the market situation. The problem here is that there are often high fees or insurance premiums to pay. Also, it is not easy to guarantee fixed spreads. Because the stock market doesn't work on principles. Fixed spreads are often unnatural.

XM offers direct interbank spreads for your clients. It also has the advantage that there is no conflict of interest. Spreads are reduced to the lowest And you always get the current market price directly. It doesn't get any better. XM is very transparent here and reaped a clear advantage for us.

XM always offers the best and tightest spreads.

(Risk warning: 75.59% of retail CFD accounts lose)

Make your first deposit (minimum deposit)

Now it's your turn to invest in a trading account. from our experience This method works pretty fast too. We will provide an overview of this section on payment methods. You can use traditional electronic or wire transfer methods for depositing. Using electronic methods (credit cards, e-wallets, Skrill), funds are transferred directly to the account. Bank transfers can take 1 to 3 days. There are no fees for deposits. The minimum deposit is only $5 with this online broker .

Review of withdrawals at XM

Another important point of a good broker is quick and easy customer payments. It is not uncommon for brokers to experience large payouts and delays.

This is not the case with XM. The company is liquid and payouts are made in less than a day. Therefore, the fee must be looked for in vain. The only fee that may arise is if you pay less than $200 by bank transfer. Based on our experience with XM, you are with a very safe broker who takes care of clients' funds with utmost confidence.

Payment terms:

- Credit Cards (Visa, MasterCard)

- Electronic wallet (Skrill)

- Bankwire

- Minimum deposit 5$

- Withdraw money within 24 hours.

- No withdrawal fee (except for bank transfers under $200)

Is there negative balance protection?

Cruel stories about account balances Thanks to the extra payroll that haunts the internet. Many traders are afraid of additional funds and want to operate without them. These concerns are all valid.

With XM.COM there is no additional payment obligation. The balance cannot end in a negative balance. The broker will automatically stop all postings first. If the account balance is negative, XM will compensate him. (very unlikely)

(Risk warning: 75.59% of retail CFD accounts lose)

How does a broker make money from you?

XM generates income through a variety of channels that cater to the needs of diverse clients. The XM broker's main source of income is from spreads. It is the difference between the bid price and the ask price of a financial instrument. This spread is slightly marked up. This allows brokers to earn profits from each trade executed on their platform.

In addition, the XM broker may charge commission in certain accounts or services The company also benefits from overnight fee Also known as swap fees. This is charged to traders who hold positions overnight. These swap fees are based on the interest rate difference between the two currencies in the currency pair. By taking advantage of a combination of spreads commissions and swaps, the XM broker can maintain operations Constantly improving the platform and provide traders with a smooth and efficient trading experience.

XM support and service for tested traders

With XM you can get more than one trading account due to the large number of employees of the company serving clients. Customer support is available in more than 30 languages. International employees also work for the company and help you around the clock. Use phone, email or chat support.

For example, you can access professional training and webinars. Webinars are held almost daily and are accessible to all clients. There are also daily market analysis and even trading signals. Another plus is the personal account manager from XM. Each client is assigned a staff member who is available for questions and suggestions. It tries to find the best deal for you as a trader.

In conclusion, we can say from my experience that the analyzes offered etc. are applicable to my own trading very well. Beginners and advanced traders can expand and develop their knowledge for free. Also, the service impressed me.

Facts about the service:

- personal account manager

- 24/5 support in different languages

- Daily webinars and analytics

- Service for beginners and advanced traders

(Risk warning: 75.59% of retail CFD accounts lose)

What is the best XM broker alternative?

If you are still looking for alternatives We introduce you to the best options on the market.

Conclusion of XM Broker Review – Scam or Trusted Company?

XM is comparable to other brokers and has received a very good rating from me on this page. with multiple licenses and regulations The company therefore offers a high level of security and reliability. In addition, client funds at XM are managed separately from the company's funds. which eliminates conflicts of interest

Overall, the broker with 1000+ markets offers a lot for private traders. For example, a market from a distant country. The portfolio will be supplemented with new markets. The MetaTrader trading platform is also perfect for analyzing requirements and opening trades. This broker guarantees 100% diversification for its clients.

Another plus is the trading conditions and deposit and withdrawal. The fees are so low that XM is considered one of the cheapest brokers out there. Rounding off the positive qualities of the company is the customer support. At XM you can get technical support and a great way to educate yourself in trading.

Advantages of XM:

- More than 1000 different assets

- A regulated and secure company

- Cheap trading fees

- No hidden fees

- 3 different account types

- Metatrader Software

- Professional support and service

- Accepting foreign customers (Europe, Africa, Indonesia, Asia, India, China, etc.)

In summary, XM is recommended and reliable. Forex Broker . We highly recommend this company after our tests. Happy Trading  (5 / 5)

(5 / 5)

(Risk warning: 75.59% of retail CFD accounts lose)

Frequently Asked Questions – Frequently Asked Questions About XM Forex Broker:

Is XM.com regulated?

Yes – XM.com is regulated several times. The Company holds the following licenses: CySEC (Cyprus), ASIC (Australia), IFSC (Belize). It is licensed according to the EEA Freedom of Service in Europe and is therefore registered in several regulatory registers.

Can I test XM.com for free?

Yes – XM.com offers all clients a free demo account to test the platform and the market. The account is full of virtual money. and you trade without risk A demo account is ideal for gaining new experience or developing strategies for trading.

What markets does XM.com offer?

Yes – XM.com offers all clients a free demo account to test the platform and the market. The account is full of virtual money. and you trade without risk A demo account is ideal for gaining new experience or developing strategies for trading.

What is the XM broker's minimum deposit amount?

The minimum deposit amount at XM is $5 for both standard and micro accounts. In addition, the “very low account” spread from XM is also available to traders for $50.

There are no deposit charges with XM. This is great since the broker gets nothing on the deposit. So you don't have to worry about how much your bank or even a third party service provider will charge you to send money.

Is XM a Trusted Forex Dealer?

Yes, ASIS in Australia and CySEC, two of the world's leading regulators oversee XM. Moreover, it has been in operation for over ten years. They have become a reliable CFD and FX broker.

What withdrawal options does XM offer?

XM withdrawals can be made using MPesa, bank transfers, as well as eWallets such as Skrill and Neteller, with the exception of bank transfers. Withdrawals usually occur within hours.

The most popular withdrawal method is bank transfer. They are offered by most brokers including XM, so they are available everywhere.

In addition, XM allows you to withdraw funds using debit or credit cards. This is an advantage for XM as very few brokers offer this option.

(Risk Warning: Your capital may be at risk)